QVprod wrote: ↑08 Aug 2022

. They thrive as a niche product.

Yes, I think I would have, perhaps naively, agreed in previous years.

Being

perceived as a niche product has perhaps been a lot of its charm over the years, and it makes me consider how being seen as the underdog can be a legitmate marketing tactic for a business and is likely a notion they've subtly used to their benefit in the past. However, with your own use above of the term "relative", well, aren't "thrive" and "niche" also relative terms? We might see it as thriving. They demonstrably don't.

Actively "thriving" as a niche product I'd suggest doesn't jibe well with the act of moving to a subscription system, as that's solely about tying people down into maximising revenue out of users, literally nothing else. It is not to lower the cost of entry, although of course it does looks like that in the short term, so they play on that in marketing to their benefit. It's always "just £20 a month!", not "just £240 year!" If they were happy and thriving on perpetual revenues as a niche product, they'd have no need to convert to subs and just be happy pootling along as a decent mid-size business as they were under Ernst.

If they're thriving as a niche product, then the revenue spikes and troughs we can see over the past 12 years balance out and that's all quite normal. There are good years, there are lean years, but it all averages out to a niche, but thriving business overall.

That they're changing that means they consider they are either not actually thriving, or they don't want to be niche. So either they just want to maximise revenue on the same number of users and remain niche, or grow to such an extent they are not niche and but additionally need to maximise revenue with the increased likelihood of user churn. Either way, you can't be both niche and massive!

But they believe—maybe rightly, maybe wrongly, only time will tell—they can earn more money off their niche product by moving everyone to subs, and at some point down the line—they're playing the long game here—people who don't want to pay subs will, eventually, be told to pony up monthly with the rest or fuck off. We reasonably guess that's the case that's the psychological game being played in everything Agevik writes, by undermining perpetual users as users who don't pay their a fair amount and are somehow now, after 20 years, suddenly the only thing ever holding RS back [from not being niche!!], and in doing so creating an us/them division where subbers can look down on perpetual license holders as inferior, and guilt users into getting subs in order to support RS. It's weaponised FOMO as a marketing trick, one that scammers use a lot. That was the intent, or else why bring it up? I can't find his exact quote now on the blog atm, maybe it's been removed, and I can't recall the exact phrase other than it was discussed on RT at the time so it's probably around here somewhere.

Here's something he wrote I did find again and is something only a marketeer could write:

"believe it or not, there are actual real people who prefer to subscribe over buying. In fact, we’re pretty sure about that because we confirmed it with both of them before launching Reason+. "

Let's apply some basic critical thinking. He's written that they asked people if some people like something and people agreed that some people can like something they don't like.

Quelle surprise!

One arguable takeaway from that is people who hate subscribing and prefer to buy is actually the vast majority, or else he'd publish the figures demonstrating that's not true, given he's so happy to even mention it. The latter half of the statement is just plain weird and is one of those phrases that look positive but actually says nothing: using a

generous reading they confirmed that users who prefer to buy also believe there are also users who prefer to rent. Well, yeah, ok. Er... And?! Your point, Nik?

What, exactly, does that tell anyone about anything? It's bizarre. It's like asking someone with dairy intolerance "Does anyone else eat cheese?" The only possible answer is "yes". But selective use of stats can leave the impression of the result only being in favour of the message you want to transmit.

I've seen their questionnaires before. I'm pretty confident I can tell you with near-precision how this went down even though I didn't do whatever questionnaire that gem came from:

Code: Select all

Question 1: Do you like Subscribing to software? Yes / No? : "NO"

--->"No": GOTO 3: Question 3: Do you think some people prefer subscribing to software? Yes / No? : "YES"

The

only reasonable answer to question 3 there is Yes", because the respondent would be aware that saying "no" would make them sound like a fucking moron and as fans of a product people using that product generally want to be seen as being helpful and honest to a company they want to trust, and not be seen as a complete idiot. So the only valid answer there is "yes". That trust, however, is now actually twisted because now RS can say they have data that says everyone agrees there are people who prefer subs. The intention of which is they hope people read it as "people prefer subs", and so if you don't prefer subs you're the one who's wrong and needs to get with the program. It's the reverse of negative marketing. Intentionally ignore Q1 completely in the results and focus on the overwhelming numbers of people who answered "Yes" to Q3. It's insidious.

Then add statements like:

"many of you are coming around to seeing that Reason+ is actually a pretty good deal" . Keep hammering the message constantly and consistently and hope it gets through, that R+ is better value than Reason 12/upgrade, even though for I suspect a majority it isn't going to be.

This is fun too, remember this?

- chart1.png (3.62 KiB) Viewed 11379 times

"Monthly Reason users over the last few years", published 7 September 2021.

You can tell it's misleading due to the lack of any numbers, dates or general reference points, and there is no breakline to condense the upper scale, so the bars are linear and contiguous. If baseline is zero, then wow, that looks jolly great.

But it's hard to believe they'd doubled users in 24 months, looking at the 2021 results again, so that baseline isn't zero. If we made the baseline an arbitrary 40,000 and each line represents just 20, that's not looking so good now, is it?

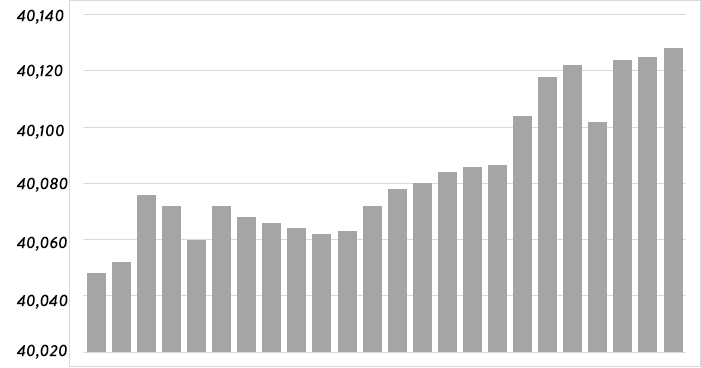

- chart2.png (8.72 KiB) Viewed 11379 times

Now obviously—cos clearly my sense of humour isn't that obvious to some—my figures are an extremely stupid example just to highlight the equally extreme stupidity of showing that chart in the first place, but it reveals the deliberate manipulation of how they present but mispresent data, that publishing it in that format

wasn't stupid, it was very, very deliberate. If we conclude they've not really doubled active users in 24 months, then in reality maybe that period might not actually be up to August 2021, instead maybe covers Covid and is actually 2018-2020, and shows that a lot of existing lapsed license holders opened up Reason in a way that connected to their server to register it as being open/updating

at least once during lockdowns to stave off boredom. That could conceivably be a figure well into the hundreds. Or it indicates a lot of people trialled Reason during the graphed period, and that's still classed as "using Reason". In other words, it says somewhere between nowt and bugger all about growth of users or growth of revenue in relation to actively paying users.

All that said, I'm using the generous assumption that "we asked both of them", in Agevik's embiggened quote above, refers to two separate

groups of multiple people who like and don't like subscribing, and doesn't mean they literally asked only the two people who they already knew both happened to prefer subscribing and are basing their entire subscription transition on that ...

Yup, given their disingenuous and misleading use of words and pictures, you're not so sure that my long-winded generous assumption holds up now, are you?